The Challenges with Decentralization in Web3 Ecosystems

Decentralized Web3 crypto-economic networks offer a compelling alternative to traditional Web2 protocols. Despite their potential, these networks face challenges with centralizing stakes within their validator ecosystems. The primary issue is that smaller validators struggle to compete with larger counterparts.

Introduction:

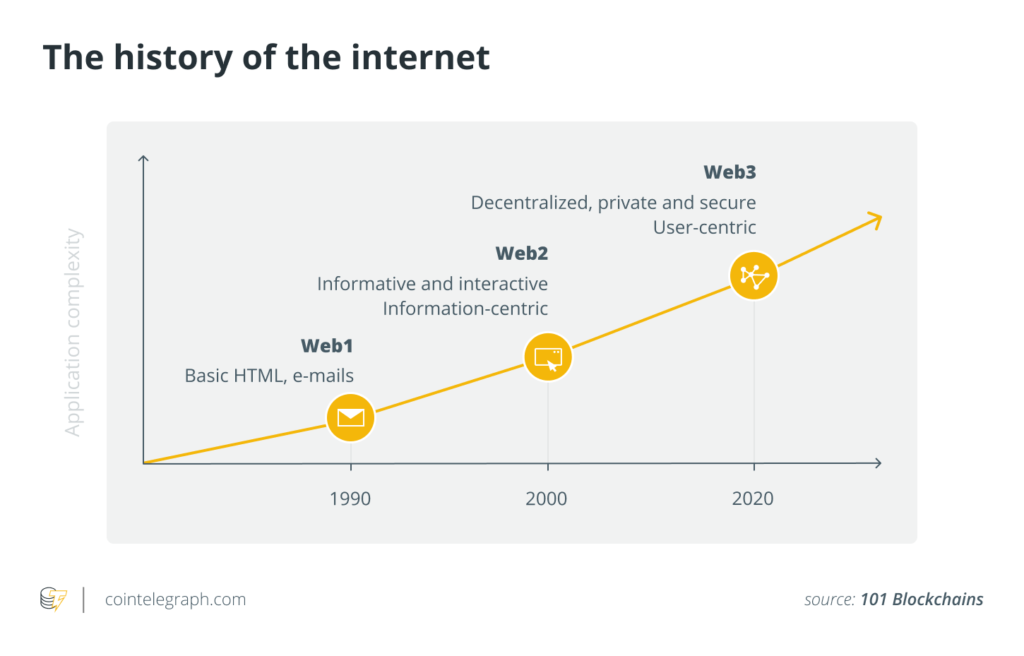

Originally, the internet was designed with a decentralized network architecture, providing numerous benefits such as enhanced security, fault tolerance, scalability, transparency, and resistance to censorship. However, the rise of dominant ‘Web2’ tech giants led to a concentration of power and control over the web. This shift introduced significant challenges, including censorship, data security concerns, and the widespread dissemination of misinformation. The advent of ‘Web3’ seeks to address these issues through global, distributed networks that highlight decentralization. By leveraging crypto-economic networks, Web3 combines the decentralized spirit of Web1 with the advanced functionalities of Web2.

Crypto-economic networks are adept at facilitating complex interactions between providers and users in a decentralized manner, using native tokens instead of a single central provider or governing body. Providers can offer services and receive native token rewards, while users can purchase services using these tokens. Decentralized network validators manage network accounting and operations, verifying transactions and earning rewards based on their stake. Additionally, delegators stake their native tokens to support network security alongside validators, sharing in the rewards. This system aims to distribute network ownership and responsibilities among participants, maintaining a decentralized infrastructure and democratizing control through governance. (source)

The Root of the Problem

The root causes of stake centralization are clear. Delegators are primarily driven by economic incentives, making top validators the most appealing due to their higher staking rewards. This advantage allows top validators to become more competitive, creating a self-reinforcing cycle. For example, within a typical Web3 validator ecosystem, most validators achieve acceptable performance levels, with uptimes exceeding 99%.

However, factors such as brand recognition, sales and marketing budgets, and competitive commission rates are what top validators use to attract delegators, benefiting from economies of scale. Top node operators, with substantial capital, are better positioned to exploit these economies of scale, thus more likely to attract new stakes. Consequently, smaller operators find it challenging to vie for delegators. This centralization of stake within proof-of-stake networks jeopardizes the fundamental decentralized ethos of crypto-economic systems.

“…we should be focusing on decentralizing validator holdings and staking services. The money is aggregating while we pay attention to the client adoption percentages, proof of staking is an inherently centralizing force and if we don’t address that it doesn’t matter how many execution clients there are.” Ethereum Researcher, James Prestwich (13:11 – 13:33) – (Galaxy Research – Infinite Jungle)

So How Do We Determine Decentralization?

In short, the Nakamoto Coefficient is the answer but what is it?

The Nakamoto Coefficient provides a quantitative measure of a blockchain’s decentralization level. It’s defined as the minimum number of entities (like nodes or miners) needed to disrupt the network’s operation. Higher values suggest stronger, more decentralized networks. Understanding this helps stakeholders assess network resilience against collusion and attacks. (source)

Named after Bitcoin’s creator, the Nakamoto Coefficient honors Nakamoto’s vision of a decentralized financial system. The naming reflects the values of autonomy and reduced central control championed by Nakamoto.

Today, this coefficient is utilized across numerous blockchains to monitor and improve their decentralization status, ensuring no single party can unilaterally alter the blockchain’s state.

Calculating the Nakamoto Coefficient

Step-by-Step Guide: How to Calculate the Nakamoto Coefficient

-

Identify the entities (like nodes or miners) within the network.

-

Assess the control each entity has over the consensus process.

-

Determine the smallest number of entities needed to achieve control over the network’s activities.

A higher Nakamoto Coefficient indicates a more robust and secure network. Analyzing these figures helps in benchmarking different blockchains against each other. While Bitcoin has a relatively high coefficient, suggesting strong decentralization, Ethereum is exploring new ways to enhance its metric through updates like Ethereum 2.0. Protocols like Polkadot seem to be leading the charge in decentralization and the nakamoto coefficient. (source)

Smaller networks often face more significant challenges in achieving high decentralization due to fewer nodes. Understanding and improving their Nakamoto Coefficient can boost their resilience and attractiveness as decentralized platforms.

Data from blockchain analyses indicates a positive correlation between high Nakamoto Coefficients and enhanced security and operational performance, underscoring the importance of decentralization in blockchain architecture.

Conclusion:

In conclusion, while decentralized Web3 crypto-economic networks present a groundbreaking alternative to traditional Web2 protocols, they are not without their challenges. Centralization of stakes within validator ecosystems remains a significant issue, predominantly due to the economic incentives that favor top validators. This creates a cycle where larger validators continue to gain more control, undermining the core decentralized principles of Web3.

Understanding and addressing these centralization issues is crucial for the sustained growth and resilience of decentralized networks. The Nakamoto Coefficient serves as a vital tool in this regard, providing a quantitative measure of a blockchain’s decentralization level. By leveraging this metric, stakeholders can assess and enhance the decentralization of their networks, ensuring they remain robust against potential collusion and attacks.

Moving forward, it is essential for smaller networks to strive for higher Nakamoto Coefficients by fostering a more competitive environment for smaller validators depending on the goals of the underlying network/protocol. This can be achieved through economic incentives, technological support, and community-driven initiatives. By doing so, Web3 networks can uphold their decentralized ethos, offering a more secure, transparent, and resilient alternative to centralized systems.

Ultimately, the pursuit of decentralization within Web3 is not just a technical challenge but a fundamental mission to democratize control and empower users. As the ecosystem continues to evolve, maintaining a focus on decentralization will be key to realizing the full potential of blockchain technology and achieving a truly decentralized internet.

Hi, this is a comment.

To get started with moderating, editing, and deleting comments, please visit the Comments screen in the dashboard.

Commenter avatars come from Gravatar.